Mortgage Experts

You should always verify financial information given by “experts” regarding mortgages. The “Panel of Experts” section in a recent special advertising feature, circulated by a Canadian newspaper is a case in point.

QUESTION #2

A panel of four experts were asked the following question.

How can I save money on my mortgage?

CORRECT ANSWER:

Shorten your amortization period!

You can indirectly shorten your amortization period by paying the largest weekly payment your budget can afford.

By increasing your payments you automatically reduce the amortization period. Weekly payments in excess of the accelerated weekly payment is best, if your budget can handle it. In fact if you paid the mortgage back completely one day after borrowing the money you would be charged interest for one day (obviously your mortgage would have to be “open”).

WRONG ANSWER:

A longer amortization period paired with an accelerated payment strategy is suggested.

I always recommend using a mortgage broker as a first choice when securing a mortgage over using a Lender’s in house expert, who has a vested interest and/or an understandable bias. However not all mortgage experts are created equal. The last sentence is not politically correct, but it is true! Sadly, in today’s western society we are so bent on viewing everything through the equality lens we have lost the ability to call a spade a spade for fear of someone’s self esteem being bruised. The best way .. I repeat, .. the best way to minimize interest costs (read: save money) on your mortgage is to pay back the mortgage as quickly as possible. This is achieved by having the smallest amortization period possible. For a lot of people this is just common sense or intuitive.

For a given interest rate the interest cost on the very first payment is the same regardless of the length of the amortization period. A longer amortization period makes your blended monthly payments lower and therefore less of the blended monthly payment is applied towards reducing your balance each month. The lower monthly payment means less principal is being paid off with each blended payment therefore interest at the end of each month is being calculated on a larger outstanding balance. Doing accelerated payments after the fact is not going to cut it because the initial high interest damage is already done.

The vague answer to question #2 by Mark Kerzner is confusing and misleading. His statement, if true, “paired with an accelerated payment strategy” is nonsense. I would like to think it was a typing error on the part of the publisher.

A+ and kudos to Gary Meger and Brad Lamb for giving sound advice about shortening your amortization period. C+ for Martin Beaudry for giving a typical Lenders opinion. F for Mark Kerzner for convoluted nonsensical advice, if its not a typo error. I purposely chose the old school technique of grading because mathematics is a black and white issue. There are correct and there are wrong answers. In mathematics 2 + 2 = 4 and one does not need to respect all answers or opinions, just the correct one.

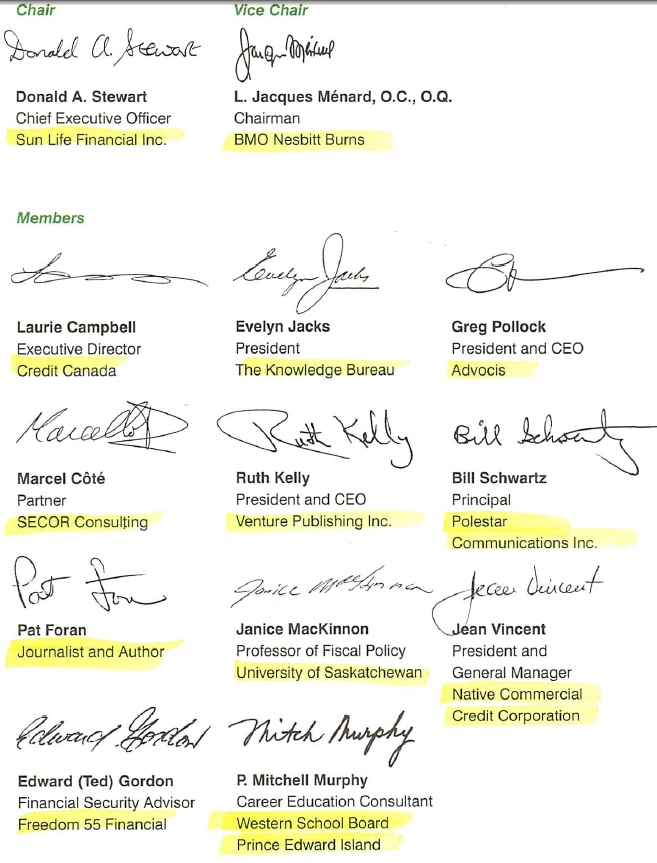

Financial Literacy of late is on the radar screen in Canada and the USA and understanding mortgages is becoming more and more important. For most people their mortgage is the biggest investment of their life yet some spend more time analyzing the family vacation plans. Its sad that a lot of people are ill equipped to analyze their mortgage options. Perhaps, just perhaps if the average American and too a lesser extent Canadian understood their basic grade twelve algebra (read: mortgage mathematics) the financial crash of 2008 might have been averted or at least it might not have been as severe. It’s ironically strange that the latest Canadian Federal government’s task force on Financial Literacy had only one high school teacher on the 13 member committee.