Financial Literacy 101

There are many reasons why Canadians are financially illiterate. An obvious reason immediately comes to mind! Yet, none of the recent 30 recommendations the Federally appointed Financial Literacy Committee (“Canadians and their money”, Dec 2010, 101 pages TASK FORCE below) came up with mention of the fact Canadians are bombarded by too much information and from too many sources and exposed to, too many confusing esoteric definitions of the same thing. One of the obvious reasons for this is too many government departments (Federal and Provincial) trying to carve out a niche for educating Canadians and in the process are duplicating efforts. On page 97 of this Financial Literacy report it was stated that nearly 700 references were consulted in compiling their 30 recommendations and virtually none of them are from teachers of mathematics. Strange! Its also interesting to note that out of the 13 appointed members on the committee only one was a high school teacher and that person was an Education Consultant, not a mathematics teacher (duh) or Math Department head. The other 12 appointed members would not be able in a court of law state they had no bias in their recommendations. This report was a feel good, white wash that accomplished NOTHING not too mention a waste of Taxpayers money! It appears that some government departments are falling all over themselves to justify their very expensive existence, by appearing concerned.

Task force to craft plan to teach money skills

Canada’s Federal Finance Minister, Jim Flaherty announced on June 26, 2009, the appointment of a new 13 member task force on FINANCIAL LITERACY that will develop a national strategy to help Canadians learn the basics.

It was reported the three areas of concern are as follows;

Financing a home

Balancing the cheque book

Saving for retirement

Donald Stewart, CEO of Sun Life Financial, chairman of this new task force, said

“our focus is going to be on practical solutions for real people in real life”. Balancing a cheque book is practical and its common sense because most Canadians can do simple addition and subtraction!

Saving for retirement is obviously practical and extremely important, however my concern is “Financing a home”. This task force is expected to deliver its findings in the fall of 2010. I assume this task force will addresses very important practical issues such as understanding mortgage interest calculations, compound interest, effective interest rates, cost of borrowing for a mortgage and premature mortgage renewal “penalties” such as Interest Rate Differentials (IRD).

A compulsory course, such as “Home Finance”, taught in Canadian high schools would be a very practical solution and prepare future Canadians for the real world. Hopefully, these new, “practical solutions for real people” will help Canadians understand advertisements such as the one that appeared in a current Canadian Real Estate publication.

Lowering your monthly debt payments is realistic and a practical solution during these tough financial times. Canadians want to remain financially afloat and not lose their homes by defaulting on mortgage payments. However Canadians should also be aware of all costs of borrowing involved or be able to calculate them.

In this example, Canadians should be able to calculate the two scenarios or at least be made aware the lower monthly payment solution has associated COSTS! These associated costs, in this example advertisement, are as follows.

1. The time to pay off the new mortgage has almost doubled (31.53 years vs 16.16 years).

2. The new mortgage costs $37,418 more in total interest ($128,342 – 90,924).

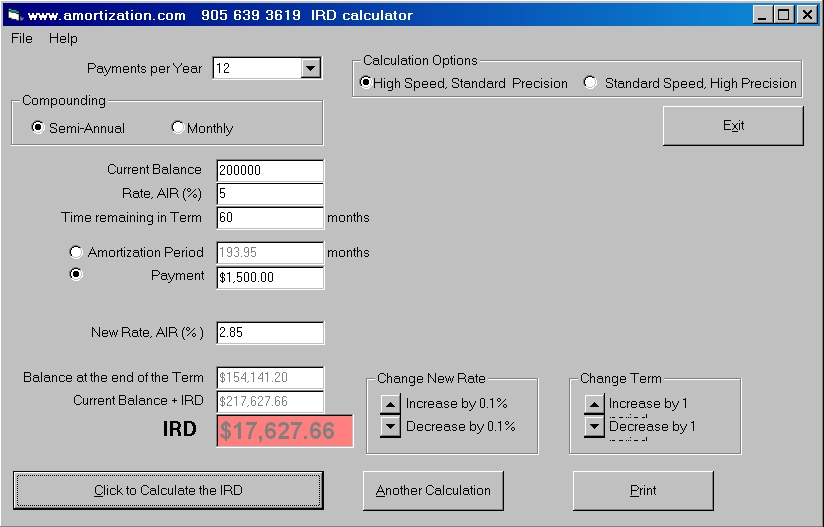

3. The advertisement neglected to mention if an IRD “penalty” is involved to prematurely terminate the existing mortgage. If the start of a five year term had to be terminated for example, the IRD would be a whopping $17,628.

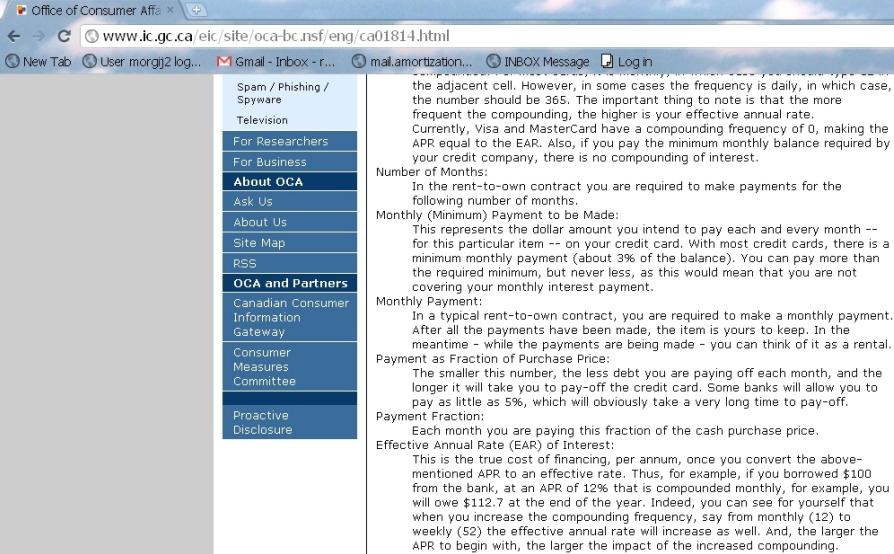

A glaring example of financial confusion, is Industry Canada’s web page endeavoring to explain the cost of borrowing terminology regarding loans and mortgages. Their definition of the effective annual rate (EAR) of interest is a perfect example of the level of confusion and it is patently WRONG!

For an annual interest rate (AIR) of 12% there is a corresponding effective interest rate (EIR) of 12.6825% if monthly compounding is in effect. Canadians would be well served if all governments standardized and used these two common sense names and were consistent in their use.

When one quotes an AIR of 12% and a corresponding EIR of 12.6825% (because of the monthly compounding) the following is implied.

If you borrow $1000 for a year and pay it back in 12 blended monthly payments of $88.85 (the last payment being $88.83) your total interest cost is $66.18 period. Ideally, the lender receives the 12.6825% interest rate IF and only IF each monthly payment is reinvested as it’s received. This 12.6825% is also called the “yield”.

If the lender lends each of your monthly payments to someone else, at the same interest rate, as they are received, THE LENDER would achieve a rate of 12.6825% or an amount of interest equal to $126.83 at the end of the year because of monthly compounding.

The two attached amortization schedules show how the numbers were derived. The zero payment schedule shows the ideal growth scenario of reinvesting each payment as it is received. In legalese this is called “deemed reinvestment”.

The Industry Canada statement, “This is the true cost of financing, per annum once you convert the above mentioned APR to an effective rate….” is confusing, misleading and wrong! In simple English the borrowers cost of borrowing in this example is $66.18 in interest. The lender gets $126.83 only if he reinvests all the payments. The lenders ideal “return” or “yield” of 12.6825% has nothing to do with the borrowers cost of borrowing and is irrelevant. Quoting the lenders yield only serves to confuse people. For every AIR there is a corresponding EIR due to the compounding selected, or in different words, for every APR there is a corresponding EAR due to the compounding selected. There is no need to provide this additional information to a borrower.

It’s about time the Financial Industry and/or governments chose one standard method of reporting mortgage numbers. Most Canadians eyes start to glaze over when they see in legal documents and/or hear…

A nominal rate of 12% with semi-annual compounding, six months not in advance, yada yada yada and then on top of that, numerous acronyms such as APR, AIR, EIR and now EAR thrown around.

To add insult to injury the Industry Canada web site’s writer cannot even use the correct mathematics to make his point. In the web sites $100 loan example the correct yearly amount should be $112.68 not $112.70 because the conversion of 12% to a monthly compounded effective rate is 12.6825 that’s $12.68 at two decimal places added to the $100. If one is going to use numbers to help explain a definition then get the numbers right, especially when your audience may be all over the map on mathematical skills. I hate being a nit picker, BUT the Industry Canada example is a Canadian non collateral mortgage which uses “monthly compounding” instead of the regular Canadian mortgage which uses “semi-annual compounding”. Perhaps the writer was unsure of how to calculate a Canadian mortgage and therefore used an American monthly compounding example which is easier to calculate on a calculator, even though he got it wrong.