Canadian weekly mortgage vs GMAC weekly mortgage

I want to thank the person who viewed my YOUTUBE mortgage video and brought the GMAC weekly and biweekly mortgage payment plan to my attention. It has been awhile since I searched the web for weekly lenders in the USA because in the past there were none. I will strive to be more current on the USA mortgage market.

In view of the fact that Americans now have access to these new weekly and biweekly plans I will be more specific regarding my explanation why a Canadian monthly, biweekly or a weekly payment mortgage plan is better than any current USA mortgage plan. I will use the weekly example to prove my point.

The example I wanted to compare to GMAC’s calculator output is as follows.

Borrow a principal amount of $200,000 at an annual interest rate of 5% (an APR of 5% if no points are involved) amortized for 30 years with weekly payments instead of monthly payments. I chose “monthly compounding” which is usually the standard procedure for an American 30 year FRM.

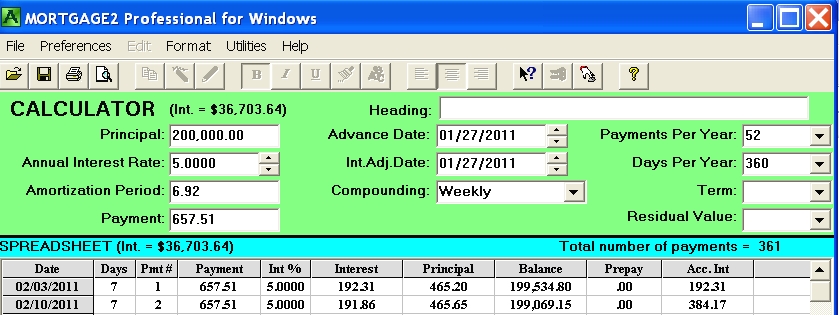

The GMAC calculator only allows a maximum TERM of 360 weekly payments which is very strange? Who can afford to have a weekly pay mortgage for only 7 years?

I therefore used a $200,000 mortgage paid back with 360 weekly payments of $657.51 and an annual interest rate of 5%. See GMAC’s calculation (Below) that indicates the interest portion of their blended weekly payment for the very first week is $192.31

The most important item to look at in any amortization schedule is the interest portion of the very first blended payment.

If you divide that initial interest portion by the Principal borrowed ($200,000 in this example) you will know the value of the INTEREST FACTOR for the period of time. In this example it’s the weekly interest factor that is used at the end of each week to calculate the interest owing on the outstanding balance. The larger the interest factor the more interest you pay. The interest factor depends upon the “type of compounding” and the number of days in the year. The more frequent the compounding the larger the interest factor. A 360 day year (aka the “Banker’s year” in the USA) for weekly and biweekly payment mortgages also gives rise to a larger weekly interest factor compared to a 365 day year factor. The number of days per year chosen by the lender influences the value of interest factor.

In this case the interest portion of the very first blended weekly payment I initially arrived at using my software (semi-annual compounding and a 365 day year which is now the defacto standard in Canada for weekly and biweekly mortgages) turned out to be $189.51 which is less than GMAC’s $192.31. The Canadian weekly interest factor (Screen C) is therefore smaller than GMAC’s method because GMAC is using more frequent compounding and also using a 360 day year in arriving at their weekly interest factor (Below).

Some may say I am nitpicking but the difference in interest costs between the GMAC weekly in this example and the Canadian weekly is (compare the SPREADSHEET (Int= of screen B and C) is 36,703.64 minus 36,034.37 which is $669.23 more in interest!

In this example, paying the same weekly payments using GMAC’s method, for the same annual interest rate for the same amount of Principal borrowed you pay $669 more in interest. The excess interest paid becomes even more pronounced when the amortization period is longer than 6.9 years. Six hundred and sixty nine dollars may not sound like a lot of money to some people but I would bet you would rather have it in your pocket instead of GMAC’s.

Would it not be more informative and transparent to American borrowers to have a comparison screen (Screen D) similar to the one major Canadian Banks provide to their borrowers (sometimes reluctantly) showing the traditional monthly payment then comparing the savings by going to weekly or biweekly payments? This is common sense. I will repeat what I said in my YOUTUBE video, not all Banks are equal.

Conclusion:

Don’t be misled by lenders who just quotes interest rates, or a lender that has a “me to” mortgage plan. You must investigate the details. The interest factor from the amortization schedule is the ONLY fool proof way of comparing various mortgage plans. This is why an amortization schedule is so very very important! In Ontario, Canada a borrower that takes out a mortgage by way of a mortgage broker is ensured of having an amortization schedule. Ontario mortgage brokers by provincial law must provide an amortization schedule within 72 hours of closing a mortgage deal. For this reason alone, I always emphatically recommend using a mortgage broker. Canadian Banks are not legally required to provide amortization schedules to borrowers. The Canadian Bankers Association’s relationship with Ottawa is an insult to Canadian borrowers. Canada’s current Federal government in Ottawa has not yet got around to mandating this important bit of Financial Literacy.