Blend and Extend Interest Rates

“Pack the mortgage when you move” is Helen Morris’s excellent article that appeared in the National Post on Saturday October 2nd 2010. The topic is dear to my heart! I agree with her message that not all portable mortgages are equal and therefore one should look at the fine print carefully. I will add to that caveat by emphasizing the importance of an amortization schedule. An amortization schedule is a financial road map! In order to

determine if a Bank is offering you a fair deal blending and extending your mortgage you require five amortization schedules. Using the articles example, assume 35 years remains in the amortization period and the balance is $250,000 and the rate is 3.59%.

QUESTION: What would the new blended interest rate be if an additional $100,000 is borrowed and added on to your existing mortgage at 7%?

In principle the analysis is simple. Use the same monthly cash flow with different interest rates and compare the outstanding balance (at 5 years) of the proposed blended loan to the total balance owing of the two separate loans at 3.59% and 7%. Five years was arbitrarily chosen. It also helps to have financial software that is able to instantly display the specific amortization schedule (Also this software must also be able to calculate any one of the four variables, once any three are entered in the calculator).

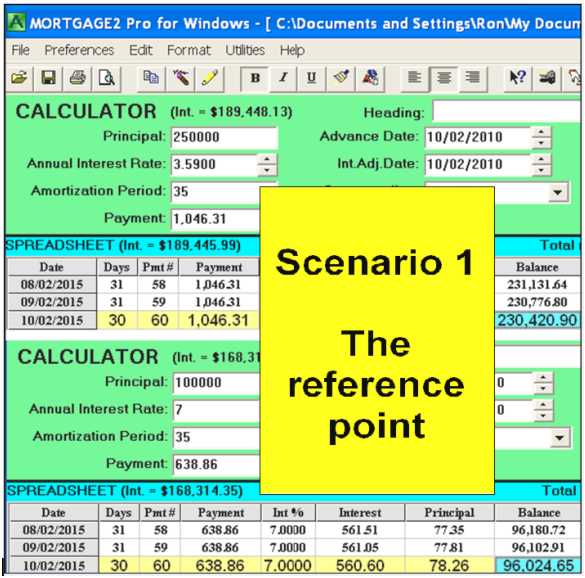

Scenario one

Two separate loans are used as the reference point..

$250,000 at 3.59% at $1046.31 per month

$100,000 at 7% at $638.86 per month

The total monthly payments for the two loans is $1,685.17

The total of the two loan balances owing after 5 years is $326,446.

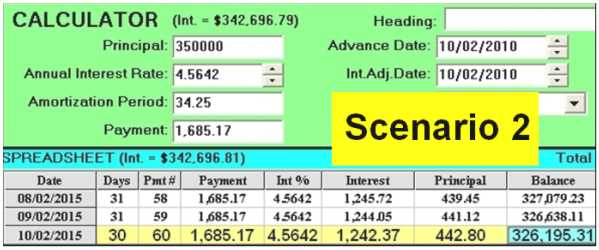

Scenario two

Using a weighted average of 4.5642% as the blended rate.

(25/35) x 3.59% plus (10/35) x 7.00%

The same monthly cash flow $1,685.17 per month on a loan of $350,000

($1,046.31 plus $638.86)

The balance owing after 5 years is $251 less than scenario one.

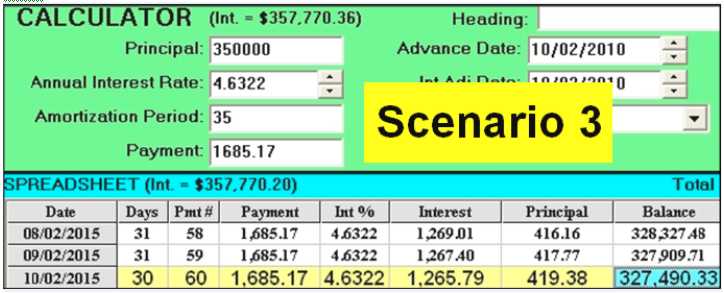

Scenario three

Letting the calculator decide the blended rate.

If your Banker used a financial calculator and entered the numbers to calculate the rate required to amortize a loan of $350,000 for 35 years making monthly payments of $1,685.17 the blended rate would be 4.6322%.

This would result in an outstanding balance of $327,490 after 5 years which is $1,044 more than scenario one.

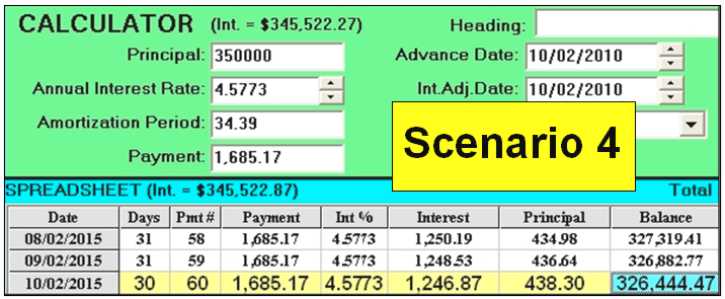

Scenario four

A trial and error blended rate..

If your Banker is fair he could offer you a blended rate of 4.5773%. He would do this by a trial and error rate until the balance owing at 5 years in the amortization schedule was the same as if the two loans were taken out separately.

A trial and error blended rate of 4.5773% for a loan of $350,000, the outstanding balance owing after five years is within one dollar of scenario one.

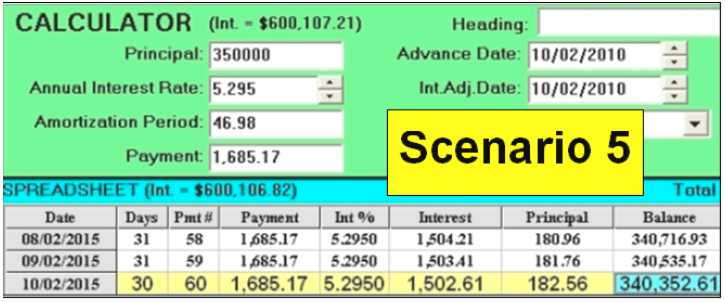

Scenario five

Using the simple mathematical average of 5.295% as the blended rate.

(3.59+7.00)/2

The same cash flow on $350,000 at the end of 5 years your balance owing is $340,353 which is $13,907 more than scenario one.

SUMMARY:

Five Years later!!!!

4.5642% weighted average saves $251 compared to scenario one (you win)

4.5773% a rate that allows the balance to be same as the two separate loans (you win)

4.6322% financial calculator calculation costs you $1,044 compared to scenario one (you lose)

5.2950% using a simple average will cost $13,907 more (higher balance owing) compared to scenario one (you really really lose)

At 2 decimal places the range of blended interest rates is 4.56% to 5.30%.

To reiterate, any time you are contemplating a blend and extend mortgage there is a possibility of being offered four options.

1.. a blended rate based upon a weighted average

2.. a blended rate for the blended loan that is the equivalent of two separate loans and thus the same balance at the end of the same period of time (5 years in this example)

3.. a blended rate as per a Financial calculator

4.. a blended rate based upon a simple average

This is a perfect example of the type of financial literacy that needs to be taught if the Canadian Federal government’s Financial Literacy objective is to be achieved! Teaching people how to budget and how to balance a bank book by telling them not to spend more money than they have in the bank each month is an insult to ones intelligence. These obvious, common sense financial literacy suggestions have already appeared in the committees pre reports to Parliament!

Let’s hope the recent Federal governments committee charged to study Financial Literacy comes up with practical, realistic suggestions on how to address financial issues such as this blend and extend loan example. A mortgage ( a loan with a special name) is the single largest and least understood investment for most Canadians! Based on questions I receive from people I can only imagine how many people fall into this confusing blended interest rate trap. The committee’s five million dollar final report to Parliament will be released at the end of 2010.

Pack the mortgage when you move

Check fine print, but it might save you thousands

Most mortgages are portable, but they’re not all created equal

There are always a lot of things to remember when packing up and moving house. You want to gather all your treasured and valuable possessions and make sure they arrive at the new place in one piece.

According to the recent TD Canada Trust 2010 Repeat Home Buyers Report, as well as packing up their worldly goods, one-third of home buyers also take their mortgage with them when they move house.

Before deciding if it is a good idea to port your existing interest rate and terms and conditions to the new place, mortgage advisors say, check rates and penalties and ask yourself how long you plan to stay in your new home.

“If you’re going to live there for the remaining term of your existing mortgage then it makes sense [to port] because you save yourself the penalties,” says Farhaneh Haque, mobile mortgage specialist, TD Canada Trust, Toronto. “You want to consider the cost of the penalty in real dollars versus the savings on the interest rate on the new property if the rate [you would get on a new mortgage] is lower. If you save more than the penalty that you pay today, then financially it makes sense for you to bite the bullet now and move into the new mortgage taking it at the current rate.”

Ms. Haque says if today’s rate is not lower, then it makes sense to take your existing mortgage with you rather than pay penalties and a higher rate of interest on a new deal.

Next question is how much equity do you have, and will you need more than your current mortgage to buy the new residence.

Advisors say check the details of your mortgage but that many lenders will do what is known as “blend and extend.”

“Say, today you have a $250,000 mortgage at 3.59% over 35 years, you’re going to be able to maintain that portion of your mortgage,” says Karen Blomquist, mortgage specialist with Mortgage Intelligence in Calgary. “Let’s say rates go up to 7%. Rather than renegotiating a brand new mortgage of say $350,000 at 7% … they’ll take the $250,000 at the 3.59% that you are enjoying today and then they’ll take the additional $100,000 and put it at the new rate and do a combination rate overall.”

Ms. Blomquist says you can look at the rate on your fiveyear deal as an insurance policy against future higher rates. She says if your mortgage is insured, say with Genworth, then check how much of a topup fee you need to pay for the new portion of the loan.

Advisors recognize that taking your mortgage with you may not be the best option for everyone.

“If you were to move in a couple of years when rates may be higher, then I can see [porting being a good option], but right now we’re dealing with people that are still with the 5.89% and 6% rates,” says Della Dwyer, a mortgage broker with Invis in Barrie.

Ms. Dwyer says she would rather see these clients pay the penalty to get out of their higher rate mortgages so she can secure them a new deal with a lower rate. She says that it is really only those people with mortgages from the last couple of years who will likely have a rate lower than that prevailing today.

Ms. Haque says factor in life changes such as maternity or retirement and check how much it would cost to release more home equity. She says check the hard cost of moving a mortgage versus potential savings.

“Most mortgages are portable but they’re not all created equal. Are there going to be any fees that I have to pay when I port this over? How do you figure out what the new rate is when you’re adding more money?” says Ms. Blomquist. “Look at the fine print.”