Biweekly Mortgages Explained

Caveat Emptor, “Let the buyer beware”. If you are an American and have a mortgage its unfortunate that you cannot get a Canadian biweekly payment mortgage. Canadian Banks and the Canadian borrowers went through the biweekly (and weekly) mortgage debate in 1984 and the issue was settled long ago. Fact, the best way to minimize interest costs on a mortgage is to pay back the loan ASAP. This simply means the weekly is the best and is better than the biweekly which in turn is better than the monthly payment mortgage! Canadian Banks offer a true biweekly payment mortgage. Americans should be aware of smoke and mirror tactics that some US Banks utilize to fool you into thinking you are getting a deal with their particular biweekly payment mortgage. Canadian biweekly payment mortgages are calculated and amortized exactly the same way as regular monthly payment mortgages. There is nothing new, under the sun, concerning a biweekly payment mortgage.

The MIGHTY BARGAIN HUNTER web site was brought to my attention by an astute American reader. Two items bothered me. The first was the web site’s statement about biweekly payment mortgages. The statement was confusing and riddled with faulty “logic”. For example, it stated that increasing your monthly payment by 9% is “almost exactly the same thing” as the accelerated biweekly payment mortgage. This is not true! The author of those words is not comparing the same cash flows. The writer is comparing apples with oranges. When performing any mathematical analysis of two mortgages one must always compare the same cash flow. The writer obviously does not understand the time value of money or the present value future value concept.

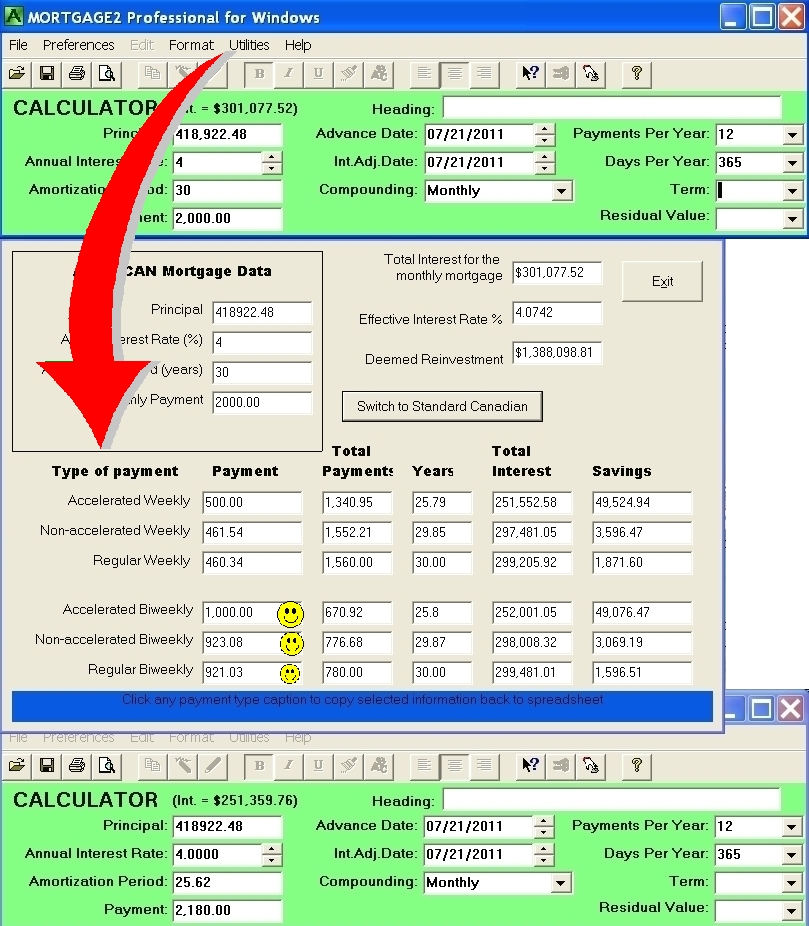

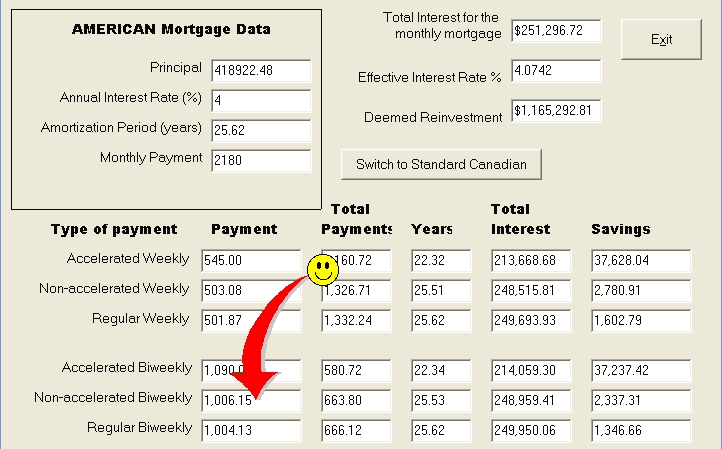

I use an example mortgage of $418,922.48 amortized for 30 years using a 4% annual interest rate. I purposely chose these numbers so the monthly payment would be exactly $2000 and thus the accelerated biweekly would be $1000. Increasing the monthly payment by 9% to $2180 instead of paying $2000 per month saves $49,717.76 in interest (301,077.52 – 251,359.76).

ACCELERATED BIWEEKLY

Going with an accelerated biweekly payment of $1000 actually saves less interest by an amount of $641.29 … BUT it’s a lower cash flow of $2000 per month rather than $2,180 per month, thus understandable once you appreciate and understand the time value of money. When comparing various mortgage options, I repeat, you must compare the same cash flows or else the conclusions are meaningless.

NON ACCELERATED BIWEEKLY

By not being aware of the non accelerated biweekly plan Americans miss out on the option of free money of $3,069.19 as in this example. The non accelerated biweekly payment $923.08 is the same yearly cash flow as the $2000 per month plan. The savings of $3,069.19 is because the bank is taking that payment every two weeks instead of once a month (therefore not allowing as much time for interest to accrue). At the end of the 29.87 year amortization period you saved $3,069.19 for doing absolutely nothing. Free money of $3,069.19 may not seem like a lot of money to some but it would at least pay for a new fridge and stove over the years! Also the non accelerated biweekly plan of $923.08 will make your budget more manageable.

Don’t take my word for it, consult a University Professor of Finance to verify my analysis and put your mind at ease. Don’t blindly accept the word of a lender who gains to make thousands of dollars of extra interest because of your financial ignorance. Some US Banks don’t like the biweekly plan, supposedly it is more costly for them to set up. All the major Canadian Banks have offered weekly and biweekly mortgages since 2004. If Canadian banks can do it, why can’t US banks?

REGULAR BIWEEKLY

If you still wanted to lower your payments even further to a regular biweekly of $921.03 (which requires the full 30 years to pay off or amortize the loan) you would still save $1,596.51 for doing nothing compared to the normal $2000 per month plan.

If your still not convinced a biweekly payment mortgage is the way to go then consider the non accelerated biweekly payment of $1,006.15 every two weeks instead of the $2,180 per month. That’s the same yearly cash flow of $26,160 but it is taken out of your account biweekly instead of monthly and again you save free money of $2,337.31 over the 25.53 years for doing absolutely nothing. A new fridge or stove perhaps?

The second thing that bothered me and it should especially upset Americans, is the unethical and confusing practices of some US lenders concerning how “additional principal” payments are handled. In Canada, any amount of money paid in excess of interest due at the end of a period of time is immediately applied towards reducing the principal (obviously the mortgage must be open with no penalties). In fact some Canadian lenders take your taxes each month or every 14 days and apply it towards paying down the principal and then add the paid taxes on to the balance at the end of the appropriate time. This lets you use your tax payments to help lower your interest costs. These are some of the fair, ethical and common sense perks that some Canadian banks follow. Perhaps that is one of the many reasons why Canadian Banks did not get sucked into the financial black hole during the 2008 US banking collapse. Canadian Banks still have pimples and worts buts that is a topic for another day.

Last Caveat, a biweekly amortization schedule is essential because the interest portion of the very first biweekly payment divided by the initial Principal (amount borrowed) gives you the biweekly interest factor, The biweekly interest factor determines how the interest is calculated at the end of each 14 day period. Lenders do not always disclose their biweekly factor. The larger the biweekly interest factor the more interest you pay!

To emphasize my last point, consider the total interest for this particular accelerated biweekly example. The potential total interest you pay can vary by as much in excess of $10,000 depending on how the bank calculates their biweekly interest factor. A ten thousand dollar plus difference in potential interest you might have to pay is a good enough reason to question your friendly Banker about their biweekly interest factor. Or just ask them what the total interest cost in dollars is going to be over the full amortization period.

Knowing the APR number as a percentage or a modified APR is not enough. The cost of borrowing number WILL NOT DIVULGE the potential variation in total interest costs. The cost of borrowing that’s reported influences the stated APR but does not indicate the numerical value of the informative interest factor, that determines the total interest costs.