A wake up call for American Borrowers

The world Economic Forum now rates the United States as having the world’s 108th most trustworthy banking system behind Tanzania and puts the USA banks in 93rd place in economic stability (page A20, National Post, Sept 12, 2009). If you have a mortgage in the USA there are valid reasons to be concerned. If you have ever missed a mortgage payment, not just recently, but in the past then a current amortization schedule from your lender is definitely a must have. Here is why!

Suppose you have a $300,000 mortgage at 6% amortized for 30 years and you miss paying the 12th payment? Both the interest portion and the principal portion of that missed payment must be paid back to the lender. If you do not have the money then both amounts are added to your outstanding balance on that 12th payment date. Your mortgage amortization schedule by definition is now accruing compound interest. Compound interest is interest upon interest. Even if you made all the rest of your monthly payments on time at the same interest rate for the remaining 29 years that missed payment would cost you an extra $10,230 in interest. If the lender charged you an administration fee of $50 to modify your amortization schedule (and added that amount to your missed payment), you would be paying an additional $248 in interest due to the magic of compounding! It’s not depressing enough that it cost you an extra $10,230 in interest due to missing a payment, but now your $50 administration fee escalates, because of compounding, to $248.

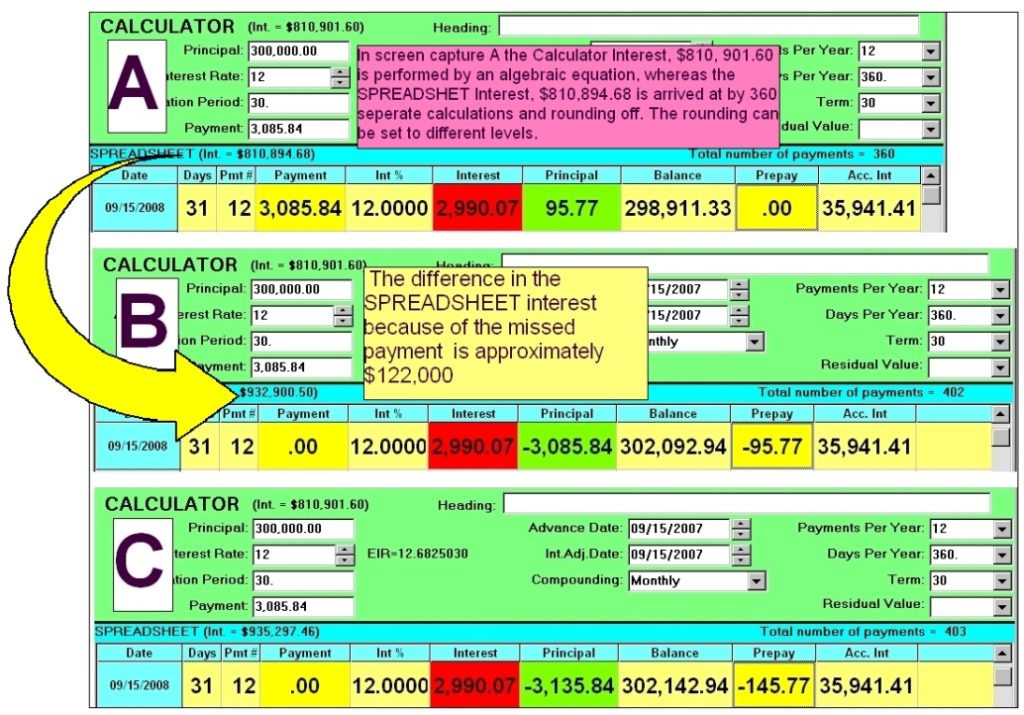

It could be worse! What if your interest rate is higher than 6%? Let’s say its 12%. If you miss the 12th payment on a 12% mortgage the extra interest cost is $122,000. If the lender also dinged you for a $50 administration fee the power of compounding converts that to an additional $2,296 after 29 years.

An amortization schedule is an essential financial roadmap. You should not leave your lender’s office without one. You would not drive across the country without a roadmap. Why would you pay into a mortgage for 30 years without an up to date history of your payments?