What is semi annual compounding?

QUESTION: A Canadian with a mortgage recently asked what do the words, “semi-annual compounding, six months not in advance” really mean? This confusing expression is legalese at it worst! This legalese usually follows the mortgage contracts annual interest rate in Canadian mortgage documents.

ANSWER: The expression does not mean mortgage interest is calculated every six months.

The legalese describes how the interest factor, for a Canadian mortgage is calculated. What is an interest factor? An interest factor is a number that is used at the end of each month to calculate the interest you owe the Bank for the use of their money for that month. This is called the monthly interest factor. Interest for mortgages is always calculated and paid at the end of a period of time, a month in this example. An ethical lender never charges interest in advance, because interest is the cost you pay for the use of someone else’s money at the end of the time period.

What is compounding? In the context of a Canadian mortgage, the word “compounding” does not mean calculation. Mathematically speaking, compounding is growth upon growth. In mathematical circles compounding is interest on interest. In other words, compound interest is interest computed on the sum of the principal and accrued interest. The word “compounding” helps describe how interest is calculated in a particular situation BUT it does not mean calculation on its own when referring to a mortgage. The phrase “semi-annual compounding, six months not in advance” on a Canadian monthly payment mortgage document does not mean a semi-annual interest calculation is performed. At the end of each month, Canadian mortgages (and also American mortgages) have the interest calculated using a monthly interest factor. The interest is simple interest.

With regard to a mortgage the only scenario when calculated interest is compounded interest is when you miss a blended monthly mortgage payment. A blended monthly mortgage payment is made up of principal and interest. The interest portion of a missed blended payment is added to the balance owing and therefore next month’s interest calculation and all future monthly interest calculations by definition are compounded interest calculations. That is the only scenario when a mortgage has compounded interest being calculated and charged to you.

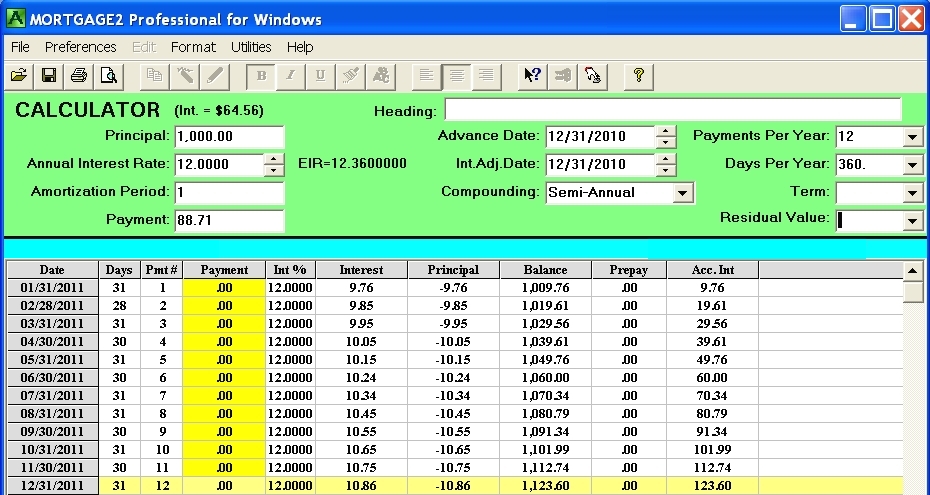

Your Banker does not leave your blended monthly payment in the Banks vault. It is assumed the bank relends your blended monthly payment on the same day at the same interest rate to someone else, therefore they are receiving interest on interest because of their reinvesting (called deemed reinvestment in legal circles). You should now realize that you are paying simple interest at the end of each month and the Bank is reinvesting your monthly payments and earning compound interest. This legalese indicates how the interest factor is calculated and also indicates how the Bank makes their deemed reinvestment if all received payments are ideally reinvested. This is easily verified by considering a $1000 loan for a year with monthly payments and an annual rate of 12%. A very simple calculation (.12 x 1000 = 120) easily shows the bank should at least make $120 in interest at the end of the year. But because of “semi-annual compounding” and deemed reinvestment the bank theoretically receives $123.60 plus the initial $1000. This can be seen from the negative amortization schedule below which shows how the deemed reinvestment works. If there was no deemed reinvestment the bank would receive only $64.52 in interest (88.71 x 12 = 1,064.52) from your 12 payments of $88.71 per month instead of the $123.60 in an ideal situation of deemed reinvest. The importance of amortization schedules (positive and negative) is once again obvious! The effective interest rate for this loan or mortgage is 12.36%. The quoted annual rate was 12% but the Bank will earn a 12.36% return if they reinvest each monthly payment.

In general, when borrowing money, the less frequent the “compounding” the smaller the interest factor. When lending or investing money the more frequent the “compounding” the larger the interest factor and thus you earn more interest. Interest factors are a double edged sword. They calculate the interest you owe and they also calculate the interest you earn. The word “compounding” helps describe how the particular interest factor is derived, it does not mean “calculation”. The interest factor directly influences the effective interest rate. Below are various effective interest rates for various compounding using a 12% annual interest rate.

Annual compounding 12.000%

Semi annual compounding 12.360%

Quarterly compounding 12.551%

Monthly compounding 12.683%

Semi monthly compounding 12.716%

Biweekly compounding 12.718%

Weekly compounding 12.734%

Daily compounding 12.747%