Negative amortization schedules can be useful

A negative amortization schedule can be a positive experience

For the last 30 years I’ve continuously repeated my mantra at my seminars, …

“an amortization schedule, … don’t leave the bank without one”

because an amortization schedule is a financial roadmap showing you how to arrive at a debt free destination. Understanding an amortization schedule is the basis of ALL financial calculations. Fibonacci outlined this famous concept in his book in 1202 AD (“Liber Abacci”, Latin for, THE BOOK OF CALCULATIONS).

An online brokerage company’s advertisement in a National Canadian newspaper reminded me of another very important reason to have an amortization schedule, a negative amortization schedule to be precise! A negative amortization schedule is when payments are missed each month and the interest owing each month is added to the outstanding balance each month. In essence it’s a grid of future values of the initial Principal (present value).

This online brokerage company wants you to purchase your Mutual Funds through them because they will recoup some of the money you lose on your mutual funds due to management expense ratios (MER). The trailer fee (the money your financial planner gets every year whether your mutual fund grows or tanks) is imbedded in your MER. It is reinvested in your mutual fund giving you a better yearly return. This is an admirable and ethical product to consider, BUT, how good is it?

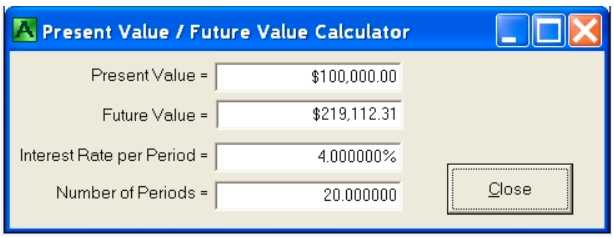

They use an example of $100,000 invested at 4% for 20 years.

Using any financial calculator you can perform a present value future value calculation to calculate the future value of $219,112 .

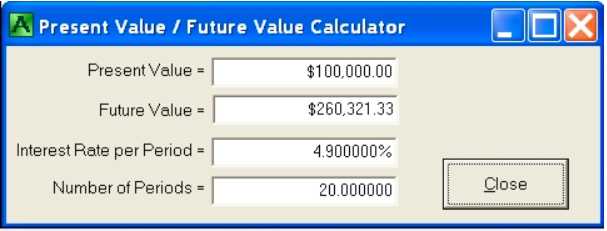

But instead of your $100,000 growing to $219,112 in twenty years this company’s MAXIMIZER program allows your $100,000 investment to grow to $260,321 after 20 years because they reinvest some of the trailer fees if there was no growth in a particular year. In essence what they could have said is we will give you a yearly return of 4.9% instead of 4%.

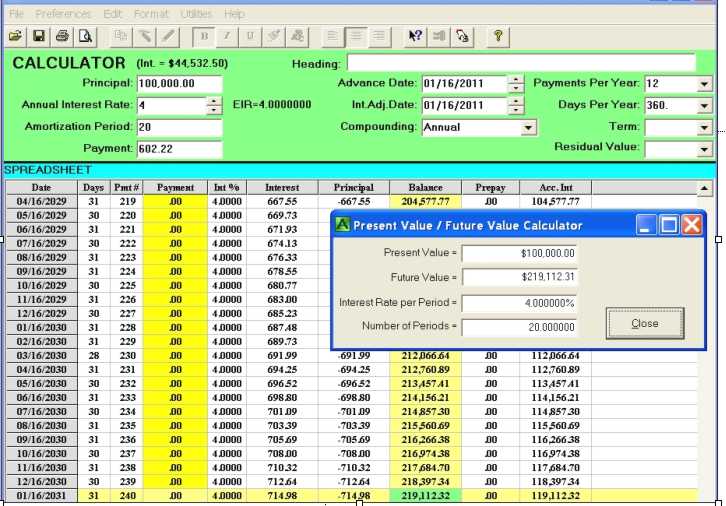

As you can see from the negative amortization schedule below the present value future value window arrives at the same dollar amount after twenty years. The negative amortization schedule provides the additional information that if you did not have the $100,000 dollars upfront to stash away for twenty years, you could achieve the same accumulation of $219,112 by investing only $602 dollars per month for twenty years.

To arrive at the negative amortization schedule below you assume you are going to borrow $100,000 at 4% for 20 years with annual compounding. That calculates the monthly payment to be $602.22 Then you just make all the payments in the amortization schedule zero and at the 240th missed payment you see the accumulation of $219,112.32

PS a common misconception explained!

By the way, … this is also called deemed reinvestment in Financial circles. If that $100,000 was your mortgage, then your Bank earns the $219,112 if they lend every single monthly payment they receive from you on the same day at the same interest rate to someone else. The Bank receives the compounded interest because they are reinvesting your monthly payments of principal and interest each and every month. If you make your payments on time and do not miss any payments, then your mortgage interest calculations are simple interest, not compound interest.